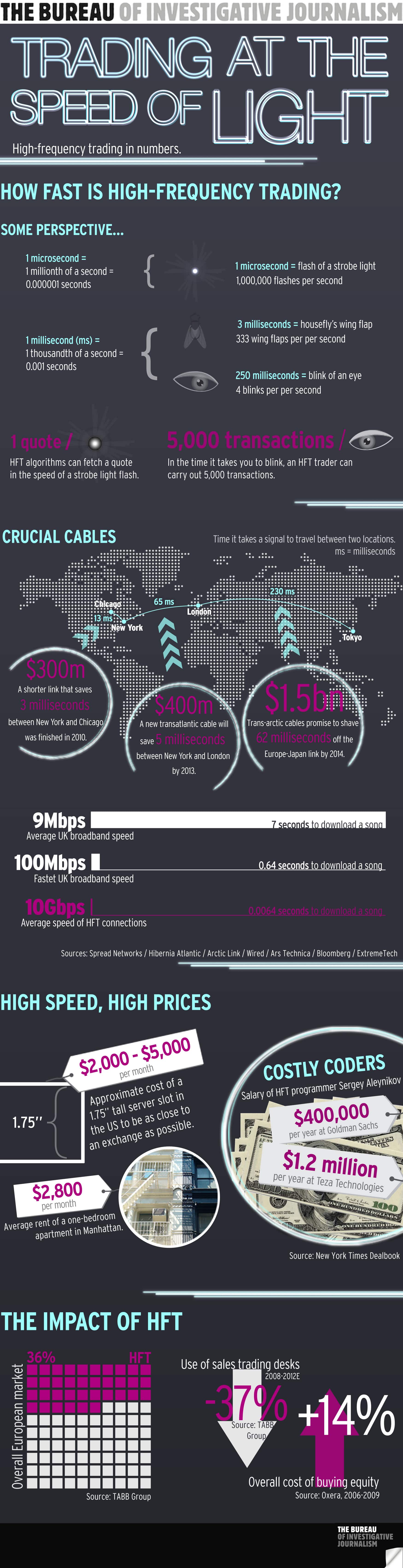

High frequency trading has existed for several years, but recently the trading strategy has come under a lot of added scrutiny. Traders utilize computer algorithms and lightning fast data connections to receive data and place trades at intervals quicker than the average trader. When you and I place trades online, a confirmation is generated in under a second. A second is way too slow for these guys.

There’s nothing illegal about somebody devising a system to buy and sell stocks at a faster rate, but many people see something wrong with HFT. A lot of these people blame HFT for causing some major market “glitches”. Which “glitches” am I referring to? I’ll list a few:

- Flash crash – May 6, 2010 “at 2:42 pm, with the Dow Jones down more than 300 points for the day, the equity market began to fall rapidly, dropping an additional 600 points in 5 minutes for an almost 1000 point loss on the day by 2:47 pm. Twenty minutes later, by 3:07 pm, the market had regained most of the 600 point drop.”

- Facebook IPO debacle – “The debut was delayed for 30 minutes because of technical difficulties. That was followed, according to a source familiar with the matter, with an “overwhelming influx of orders” to buy, sell and cancel trades causing Nasdaq’s trading software to go haywire.”

- Knight Capital system errors – This is an example of HFT gone wrong. Knight Capital had installed a software upgrade overnight and on the next day, months worth of trades were executed in 15 minutes and left the firm considering bankruptcy. “The algorithmic error caused erratic trading activity and left the firm with billions of dollars in unwanted securities.”

Even if you feel that HFT trading is perfectly acceptable and a natural progression of our society and the use of computers, you have to realize that as a “regular guy”, there’s no way that you could ever beat HFT. These algorithms analyze data and react and a speed that can never be matched by a human. As a trader myself, I witness HFT every day, but it wasn’t until I viewed this infographic that I actually realized just how fast it is:

READERS: How do you feel about HFT trading? Do you think it should regulated more or banned all together? Has HFT affected you in any manner? Facebook? Flash crash?