Currently, 45% of all homeowners contain less than 20% equity in their homes. What’s even worse is that almost 30% have less than 5% equity. That’s not surprising considering the extent at which housing prices have dropped over the last few years.

With less than 20% equity, how are you supposed to take advantage of this economy’s record low interest rates? During phase 1, homeowners were able to take advantage of HARP if they were behind on their payments. A lot of people did not agree with this policy, because people were essentially being rewarded with a lower interest rate for not paying their obligations.

Fortunately this program was expanded and phase 2 of HARP was introduced. Now, homeowners who are current on their mortgage payments are able to apply for a lower interest rate regardless of the amount of equity built into their home.

What is HARP?

The Home Affordable Refinance Program (HARP) is a coordinated effort between Fannie Mae and Freddie Mac (the Enterprises), FHFA, lenders, loan servicers and private mortgage insurers. Their goal is just as the program title suggests, make homes affordable. During phase 1 this was accomplished by allowing people who were late on their mortgages to refinance and obtain a lower rate. Phase 2 has been initiated to also provide that opportunity to borrows who paid their bills on time, as everyone should if they have the means.

The problem that we’re running into today is that millions of people do not have enough equity in their homes to qualify for a traditional refinance. This program benefits owners who fit into that category as well as taxpayers, the Enterprises and the housing market as a whole.

Requirements

Before you get your hopes up and assume that you can qualify for this program, you must first check to make sure that your loan is eligible. At this time, only loans guaranteed by Freddie Mac or Fannie Mae qualify. To find out if your loan is guaranteed by Fannie or Freddie, visit these secure links.

Besides having a loan backed by the Enterprises, you’ll have to meet these other, minor requirements:

- The mortgage cannot have been refinanced under HARP previously unless it’s a Fannie Mae loan refinanced under HARP from March – May 2009.

- Current loan-to-value must be greater than 80%. If you have more than 20% equity in your home that’s a good thing, but you’re not eligible for this program.

- The borrower must be current on the mortgage at the time of the refinance, with no late payment in the last six months and no more than one late payment in the last twelve months.

If you’re not eligible at this time, you can always contact your lender and discuss refinancing options, but unfortunately you cannot participate in this refinance opportunity. Neither FHFA nor the Enterprises have the legal authority to extend HARP to borrows holding loans not guaranteed by them.

Procedure

If you’ve discovered that you are eligible, you need to contact your lender to begin the procedure, not one of the specialized companies that constantly expose you to their advertisements. Your bank will ask for the typical loan documents, but some lending steps are not required when simply refinancing.

For one, an appraisal will most likely not be needed. The process is being streamlined and an automation valuation model will be available in most cases. You will be required to pay closing fees as usual, but your lender may apply a credit if you select a shorter duration loan. By choosing a 20 year vs 30 year for example, the loan amount will decrease faster and your lender will award you by offering to pay for some of your closing fees. In addition, you will be exempt from one month’s rent, which should help with closings costs.

Once the refinancing process is started and you’ve provided your lender with everything they’ve asked for, expect the entire deal to be completed within two to three months. Of course, continue to pay your mortgage like usual while everything is being finalized.

The Purpose of HARP

The purpose of both phase 1 and phase 2 is pretty self-explanatory – to help Americans that have little or no equity in their homes refinance and take advantage of today’s low rates. It makes sense for everybody involved if people pay less interest on their mortgages, especially with the condition of the housing market. When an interest rate is altered downward, the borrowing pays less overall interest. Keeping the same payment, the principle on the loan will decrease at a faster rate.

Although the bank is collecting less interest, their position is still greatly improved. The loan becomes less of a liability with a lower loan-to-value ratio and the borrower is more likely to continue making payments as opposed to simply walking away from the debt. From the lenders perspective, a low interest on a debt paid for is better than a high rate on a loan in default.

I think most of us can agree that little government involvement is good government involvement. Each time the government steps in and bails someone out, we as tax payers are footing the bill. Under HARP, it’s the banks that are lowering their interest to more manageable levels, making it easier for owners to pay their mortgages and actually build equity in their home that has been declining in value.

Example

Recently, I refinanced one of my rental properties utilizing HARP phase 2. My interest rate was not terrible at 6.5% for a 30 year fixed, but the home was unfortunately underwater. I have been applying extra towards the principle for the 5 years that I’ve owned the home, but the builder declared bankruptcy halfway through completion of the community, hurting the value of all the homes.

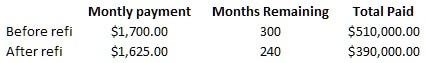

Upon refinancing, I locked in a rate of 4.375% for a 20 year fixed loan. What I had effectively done was lower my monthly payment and decrease the duration remaining on my loan for 5 years as you can see below. Who wouldn’t be happy about an overall savings of $220,000?

Conclusion

The general economy should be positively affected by both, phase 1 and 2 of HARP. The housing market will begin to stabilize as there are fewer foreclosures on the market since more people will start making payments. As a home owner, this is of course good news for you. Also, as people are making lower monthly payments as a result of a lower borrowing rate, they will have more money in their pockets each month. Additional capital will be spent on goods or services, further stimulating the economy.

Readers: What other methods can be used to kickstart this economy and help out homeowners?

Have you benefited from HARP 1 or 2? How so?