Americans Are Missing Trump’s Policies Despite Past Criticisms, New Poll Indicates

Initially, Donald Trump’s policies as president didn’t exactly win him a fan club, but it…

Initially, Donald Trump’s policies as president didn’t exactly win him a fan club, but it turns out, those very policies are hitting the right notes with Americans now. A Nostalgic Look at Trump According to the latest Harvard CAPS-Harris Poll, a solid 60% of voters are actually feeling a bit nostalgic for Trump’s take on…

Louisiana Republican Senator John Kennedy’s description of an abortion procedure during a Senate hearing prompted criticism from a witness who labeled his portrayal as purely “fearmongering.” IVF Access The Senate delved into reproductive health matters on Wednesday, with Republicans thwarting an attempt to safeguard access to in vitro fertilization (IVF) and the Budget Committee deliberating…

Close to half a million Tennesseans are set to lose their voting rights in the upcoming presidential election, as new regulations make regaining these rights more challenging. Now, certain felons will face greater difficulties in having their voting rights reinstated. Tougher Voting Laws for Felons In Tennessee, those convicted of specific felonies (regardless of the…

Following Ronna McDaniel’s resignation as the Republican National Committee (RNC) chair, with Lara Trump potentially stepping into the role, a political analyst has labeled the situation as a sign of “extinction” for the Republican Party. End of an Era McDaniel, who announced her departure on Monday amid a flurry of criticism and rumors about her…

Never-Trump conservative, legal expert, and former federal prosecutor Ron Filipkowski suggested that the visible nature of the impeachment vote saved Trump from conviction. Trump’s Narrow Escape? Former President Trump’s defense in the election case leans heavily on a claim of absolute presidential immunity, arguing he had the freedom to act as he did. Courtroom Confrontation…

Over half of Americans now back the idea of building a wall along the U.S.-Mexico frontier, a recent survey reveals, highlighting a significant spike in worries about illegal immigration. Shifting Views on Border Wall The Monmouth University poll found that 53 percent of American adults are in favor of the wall, compared to 46 percent…

A lot of Gen Z voters think Donald Trump could really shake things up for the better if he gets back into the White House after the November election, a recent poll suggests. Can Trump Win Over the Youth? Republicans haven’t had much luck winning over young voters, who usually lean towards more progressive or…

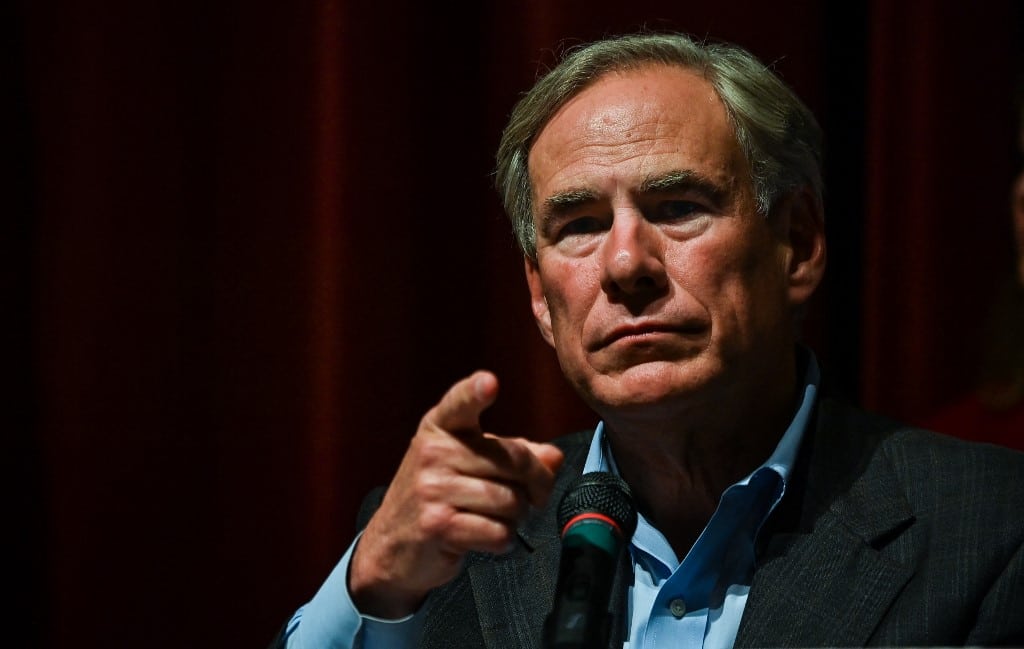

In a notable setback for Texas Governor Greg Abbott, a federal court put a pause on the state’s fresh deportation statute Thursday, which was scheduled to start on March 5. Judicial Blow to Immigration Arrests The United States District Court for the Western District of Texas stepped in with a preliminary injunction against Texas Senate…

Tom Parker is the Alabama Chief Justice who wrote the concurring opinion in the controversial ruling determining that frozen embryos should have the same rights as children. According to the Huffington Post, he recently appeared on a Christian nationalist’s podcast, where he expressed explicitly theocratic beliefs. Dodgy show The show, called “Someone You Should Know,”…

In the lead-up to a Supreme Court ruling with major implications for the 2024 election, Trump’s attorney “has faith in them” to rule in favor of Trump, stating: “The law on this is very clear.” Will the Supreme Court Favor Trump? Alina Habba, an attorney for President Donald Trump, discussed Justice Brett Kavanaugh’s role as…