How to Start Saving for Retirement While You’re Young

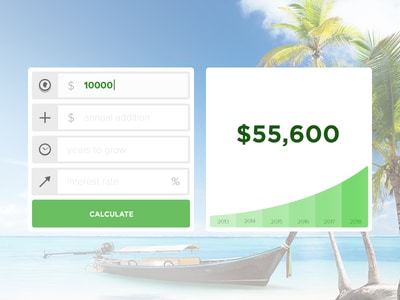

According to CNBC News, Americans should aim to have the amount equivalent to a full year’s salary in savings by age 30. By age 40, they recommend having up to three years’ salary tucked away. While these are the recommended values, the reality of the situation is much different. In fact, by 35, the average…