I was sitting in my apartment, looking over my net worth figures and feeling hopeless when a thought occurred to me. I don’t need to make any massive savings or investing moves to get rich, I just had to save, and save and save. Just to provide some background on this I was looking at my retirement plans – specifically figuring how much you need to save to become a millionaire by age 65, and was feeling pretty depressed about it. But, after some consideration, the situation didn’t look so bad.

So, how do you become a millionaire by age 65?

Save a lot every day.

It’s really that simple. Even if you work for minimum wage, you can likely spare a few bucks. All getting rich really comes down to is consistently saving, and investing that money wisely. Throw your savings into a broad index fund and watch it generate cash for you. Over time, with an average return on investment, your savings will produce money faster than you can make it at work. Having said that, time can be your biggest friend, or enemy, depending upon when you begin to save.

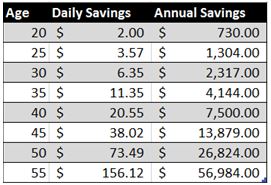

Although it may sound ridiculous, you can’t start thinking about retirement too soon. Not in the sense of where will I live or what will I do? But in the sense of how much do I need to save to be a millionaire by age 65? Again it doesn’t need to be a lot, just make a conscious effort to save. And if you’re halfway through your career already, guess what? You’re fine too. All you have to do is bump up your savings rate a bit and you’re golden. But, make sure you start today. The following chart should help determine how much to start saving, depending on your nearest age, to become a millionaire by 65.

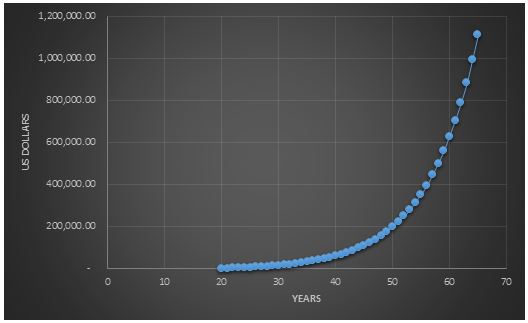

But let’s say you are 20, read this article, and because you’re so smart you start today. This is what your savings could look like over the next 45 years.

After 39 years, you’ll have somewhere around $500,000, assuming you get 12% annual returns. Not too bad. But with the power of compounding interest and continual saving, that money will double itself to over $1,000,000 six years later when you turn 65. If you could keep it up for 5 years after that, your money will double again, leaving you with a cool $2 million in the bank. Save $4 a day and you’re looking at $4 million.

This begs the question, how can I save?

Let’s look at an example. John is 25 and is beginning his first job at a bank. He’s looking at places to live but knows he wants to be able to save $1500 a year at the very least to invest.

Live Frugally. The smartest move John could make is living within walking or biking distance of work, eliminating the need for a car. That in itself would save John well over $1500 in transportation costs each year. He could also share the rent with a friend instead or buy his own place and rent out any extra rooms. These would all amount to huge savings over time. But, many people’s living situation is not always that easy to change so, what are some other options for John? He could get a Costco membership to save a ton on food (they have a great returns policy, btw), cut the Starbucks to once a week, or cut dining out to once a month. Obviously, there are a ton of ways to trim the fat here and there but take a look at your three biggest expenses, which for just about everyone will be housing, transportation, and food. While these cost us the most, they are often areas where the most saving can be done as well.

Take what Uncle Sam gives you. A second, very smart move for John to make would be to enroll in an automatic savings plans such as a 401k. These can be amazingly helpful as they tend to remove the temptation of ever spending money in the first place. So, maximize your IRA or 401ks to help get that savings rate up.

Invest and Save Aggressively. It would be foolish to not address the fact that the stock market can be a wild ride. In fact, a 12% return (assumed in the calculation of $2 a day) would be slightly above average when considering historical returns and would require an aggressive portfolio mix. The point you should be focusing on instead is that setting just a little bit of money aside can greatly benefit you down the road even if you don’t see the payoff for decades. Regardless of what the market does, focusing on a high savings rate will provide you with a buffer that can help keep you at ease in times of turmoil.

Just imagine, instead of fighting for a spot at the public beach down the road in retirement, you could be lying on the beach of your own private island. Just start saving.

Bio – This is a guest post from Brian Groener. Recently graduated from university, he is currently working as an engineer just outside Philadelphia. Although he enjoys his job and has just begun his journey to financial independence he is also an outdoor and travel enthusiast which he plans to pursue further once he has reached financial independence. He’s here to show how money can be used for freedom instead of buying more junk. If you liked this article, more of his writing can be found at www.getmoneygotmoney.com.

If you liked this article, please leave us a comment below or share it on social media.