Money anxiety is something that can affect anyone and can show itself in many different forms. The stresses of budgeting, debt, paying for a child’s post secondary or reaching financial goals can all cause money anxiety.

Money anxiety is something that can affect anyone and can show itself in many different forms. The stresses of budgeting, debt, paying for a child’s post secondary or reaching financial goals can all cause money anxiety.

How to Avoid Money Anxiety: Address the Stress

The first step to decreasing or avoiding your money anxiety is to address the stress. If you don’t know what it is that is causing your money anxiety you can’t fix it. The answer may be obvious like an overdue bill or it may be a broader issue like figuring out you’re not comfortable with your financial adviser. Once you figure out what the root of your money anxiety is, you can get started on addressing the issue.

How to Avoid Money Anxiety: Budget

A big cause of money anxiety for people is not feeling like they have control over their money. They make money but find that their paycheque is spent before it’s even deposited in their bank account, having no idea where their money is going.

Everyone budgets differently. Budgeting is a very personal thing and requires a real effort to find one that works for you. Regardless of how you choose to set up a budget, it starts by looking at your spending habits. By writing everything down, you’ll see where your money is going and how it is getting spent.

My husband and I are still working on our budget. It is constantly evolving and adapting to our life. A budget has to be adaptable if it is going to be successful. In order to reduce your money anxiety, you will have to address and monitor your budget regularly.

How to Avoid Money Anxiety: Deal With What You Know

In terms of both investing and everyday banking, deal with what you’re comfortable with. Money is a very personal issue. You should be comfortable with the tellers who deal with you day-to-day and the advisers who help with your investments.

In terms of investing and money anxiety, only invest what your comfortable with, in areas you’re just as comfortable in. I’m not suggesting you don’t broaden your wings to explore new investment opportunities, but not until you’ve done your homework. It’s fine for advisers to make suggestions but if you don’t know anything about said investments it will only lead to money anxiety, something you don’t need.

How to Avoid Money Anxiety: Save, Save, Save

Save for a rainy day. Save for an emergency. Save for retirement. If you don’t currently have any savings, start right now. Start small and build slow, but just start. Having no savings is a huge cause of money anxiety. In the case of an emergency, you never know when it’s going to happen. Having some money set aside will ease this already tumultuous time. Retirement is predictable so save for it now. If you’re in a situation where you can’t afford to save for your retirement, get a second job if you need to. You have to do something today unless you plan on working the rest of your life.

How to Avoid Money Anxiety: Insurance

We all need insurance. Not having any life insurance specifically is stressing me out. We have small policies through our jobs, and individual debts insured, but need to take out a single larger life insurance policy. Especially since we have a child now. If something were to happen to me today my husband would find himself in a bad financial situation during a terribly morose and stressful time. Having insurance policies in place will give you peace of mind.

Money anxiety is something that happens to all of us. With a few preventative steps money anxiety can be totally avoided or at the very least, decreased.

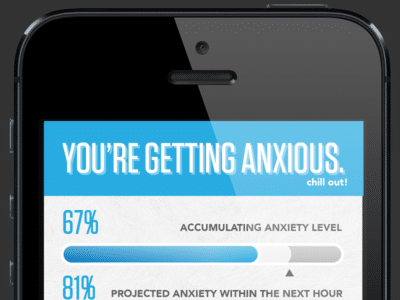

[Anxiety Head image credit http://dribbble.com/edokoa] [iPhone Anxiety credit http://dribbble.com/extremelyn]